The sports betting exchange firm Matchbook has had its UK gambling license temporarily suspended by the Gambling Commission, for reasons that are yet to be confirmed.

The sports betting exchange firm Matchbook has had its UK gambling license temporarily suspended by the Gambling Commission, for reasons that are yet to be confirmed.

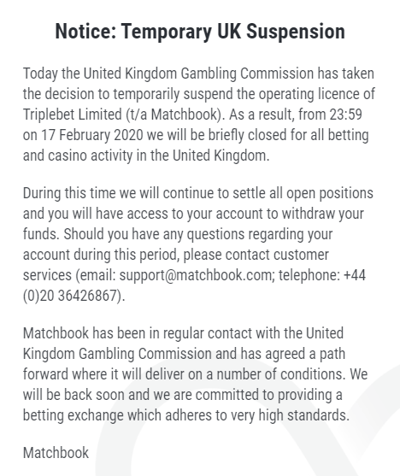

Punters with the brand were sent emails on February 17 informing them of the decision, before confirming that they will be ‘briefly closed’ for business in the UK.

No reason was given for the closure, although speculation is mounting that it may relate to a high-profile court case involving one of Matchbook’s parent companies.

Andrew Pantling, a director of Triplebet Ltd who operate Matchbook, has been embroiled in the court proceedings in which nearly £10 million has been paid out to the plaintiffs.

It is believed that the license suspension is indeed only temporary, with the brand agreeing a ‘path forward where it will deliver on a number of conditions’, according to discussions with the Gambling Commission.

The firm has promised to ‘be back soon’ as well, and confirmed that they will continue to settle all open bets while their license has been removed. Punters can also access their accounts to make withdrawals, if they wish.

Peruvian Palaver

It should be noted at this stage that the Gambling Commission has not formally given a reason for Matchbook’s licence suspension, so speculation should be treated with a pinch of salt.

However, it was reported by the Irish Independent in January that representatives of Matchbook and their subsidiary partner Eurasia Sports had become embroiled in a lengthy and hugely significant court case.

Eurasia Sports offers high-value bettors ‘unrestricted betting’, and funnels them through the Matchbook platform where they can wager without typical bookmakers’ restrictions on high roller accounts.

Then into the fray came an Irish business called Xanadu Consultancy, whose job it was to recruit big money punters to Eurasia. They found a group of individuals in Peru, who were looking to place big money bets quickly and without restriction.

And so Pantling, of Matchbook, and Xanadu’s Paul McGuinness flew out to the South American country to meet Juan Omar Machi Aguad, owner of the Atlantic City Casino in Peru’s capital Lima and a high rolling sports bettor.

Aguad wanted to wager huge sums on NFL games, and Eurasia were willing to offer him £1 million on credit with no questions asked.

“In essence, the service offered provided a brokerage product, working via Skype or over the telephone, which enabled large clients to bet considerable amounts quickly,” the court was told.

The Peruvian went on to lose his million in just a handful of bets, and went cap-in-hand to Eurasia to ask for more credit – promising to send more high rollers their way as a ‘gift’.

In the end, Aguad ended up betting through a number of associate accounts and blew millions on losing bets – up to $13 million was lost, according to court papers – which he reneged on repaying through a series of bounced cheques.

He was taken to court by Matchbook, and there the presiding judge found in favour of the firm – Aguad and his associates would be forced to pay back the full amount, describing the set-up as ‘co-ordinated deception’.