Following the news that MoPlay has had its gambling licence suspended in both the UK and Gibraltar, the company has declared itself insolvent with customers now unable to make withdrawals until further notice.

Following the news that MoPlay has had its gambling licence suspended in both the UK and Gibraltar, the company has declared itself insolvent with customers now unable to make withdrawals until further notice.

The company had a string of knockbacks prior to this including being taken to court for unpaid sponsorship by Premier League football clubs Manchester United and Watford.

The Gambling commission had said in a press statement that although the licence of parent company Addison Global had been suspended, customers would still be able to make withdrawals. That position has now changed with insolvency proceedings now taking place.

Due to MoPlay’s customers’ ‘low level’ of protection of their funds, they will now not be able to successfully request a withdrawal of their funds.

Section 9.1 of the company’s terms and conditions which are available via the website states:

“9.1 To play our games and place bets, you need to deposit funds. Your funds will be held in a separate bank account from all our other business accounts. Your funds will be held separate from company funds in a mixture of a bank account and reserve funds which we hold with our payment processors. However, if there was ever a situation where we became insolvent, your funds would not be considered separate to the other company assets and you may not receive all your funds back.”

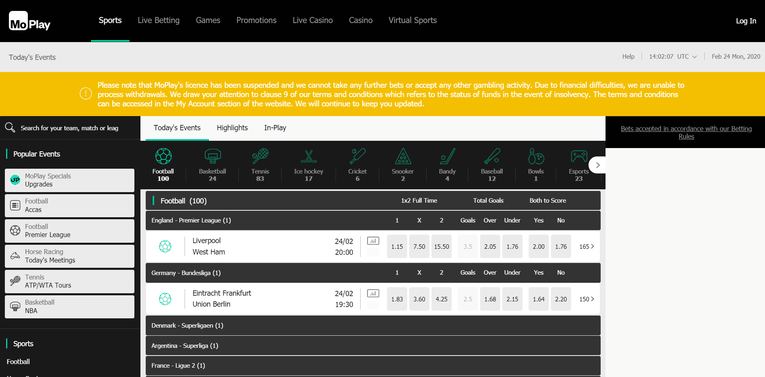

The company website now advises:

“Please note that MoPlay’s licence has been suspended and we cannot take any further bets or accept any other gambling activity. Due to financial difficulties, we are unable to process withdrawals. We draw your attention to clause 9 of our terms and conditions which refers to the status of funds in the event of insolvency. The terms and conditions can be accessed in the My Account section of the website. We will continue to keep you updated.”

Can MoPlay Hold on to Customer Funds?

Unfortunately, unlike financial guarantees given to banking customers by the Financial Services Compensation Scheme (FSCS), UK betting and gaming companies are not automatically required to give full protection to their customers funds should that company reach financial problems such as insolvency or bankruptcy.

The UK Gambling Commission do require that betting companies operating in the UK state whether they provide low, medium or high protection in their T&Cs.

- Not Protected: Customer funds are viewed with any other company monies and so are not protected if the company goes bust

- Medium Protection: The company has insurance to protect customer funds in the event of going bust

- High Protection: Customer funds are held in an account legally separate from the company’s, controlled and audited independently

MoPlay offers the lowest ‘Not Protected’ level to its customers so it remains to be seen what happens to these funds as they will be linked to what happens next to the firm.

Update 16th March 2020: Betfred Take Over UK & Ireland Customers

Following an auction, UK bookmaker Betfred have taken over MoPlay’s UK and Ireland customer base. Those involved will be contacted by Betfred who will inform them how to proceed. It is thought that customers will either be able to withdraw their funds, or transfer them to a Betfred account.