It’s a takeover bid that would have created an international gambling behemoth.

It’s a takeover bid that would have created an international gambling behemoth.

But MGM yesterday revealed that they will not be lodging an improved offer for Entain, the British gambling operator that owns Party Casino, Gala, Ladbrokes, Coral and many other brands.

The American firm had initially valued Entain at £8.1 billion and tabled a takeover bid on those grounds, however this was rejected by the brand who claimed that it ‘significantly undervalued’ the worth of their business.

The pair had worked together on a joint venture to launch the BetMGM platform, and most in the industry expected them to have their way with Entain by placing a higher bid – particularly as the UK firm’s CEO, Shay Segev, announced his plans to walk away from his role and take up a similar position at DAZN.

But the casino powerhouse has now confirmed that after ‘careful consideration and reflection’ they will not be revising their initial bid, and now the takeover is very much off the table as a six-month ‘cooling off’ period is mandatory under takeover law.

A Difference of Opinion

Under the statutes of the City Code on Takeovers and Mergers, MGM had until February 1 to submit a new offer for Entain – most expected them to take the opportunity to do exactly that.

Picking up Entain’s myriad of betting brands would give them access to a number of new online markets around the world, allowing them to diversify their position at a time when land-based casino revenue has been hit hard by the coronavirus pandemic. Furthermore, the takeover would have allowed MGM to tap into Entain’s expertise in online sports betting, which is expected to be a huge growth sector over the next few years.

The problem was the valuation, with MGM offering Entain’s shareholders an all-stock offer that valued the firm at around the £8 billion mark, with 0.6 shares in MGM offered for each whole stake in Entain. The latter’s shareholders would have owned 41.5% of the newly amalgamated operation.

A workaround seemed to be viable when InterActive Corp, who were funding MGM’s bid, confirmed that they were willing to splash $1 billion on cash investments to entice shareholders not willing to take on further shares for their original Entain holding.

Initial reports suggest there will be no fall-out from the shenanigans, and that the duo will continue to work closely on the BetMGM brand as it looks to crack the US market currently dominated by DraftKings and FanDuel – a dual $200 million investment, pumped into the coffers last year, should certainly help on that front.

“We believe that BetMGM has established itself as a top-three leader in its markets and we remain committed to working with Entain to ensure its strong momentum continues as it expects to be operational in 20 states by the end of 2021,” MGM Resorts’ Bill Hornbuckle said in a statement.

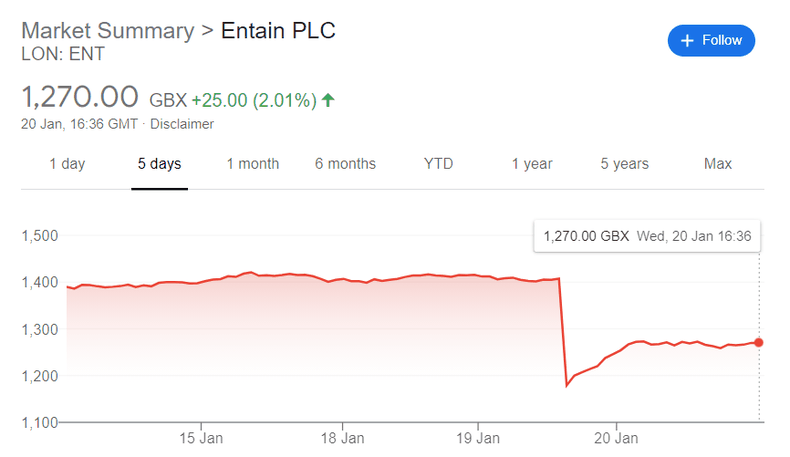

However, it’s not all good news for Entain’s shareholders. When it was revealed on January 19 that MGM would not be upping their offer shares in the firm fell by an eye-watering 16.5%.